Shape the Future of Finance with Digital Transformation

Table Of Contents

Stay In-the-loop

Stay In-the-loop

Get fresh tech & marketing insights delivered right to your inbox.

Share this Article

Tags

Category

- .Net Developer

- Adtech

- Android App Development

- API

- App Store

- Artificial Intelligence

- Blockchain Development

- Chatbot Development

- CMS Development

- Cybersecurity

- Data Security

- Dedicated Developers

- Digital Marketing

- Ecommerce Development

- Edtech

- Fintech

- Flutter app development

- Full Stack Development

- Healthcare Tech

- Hybrid App Development

- iOS App Development

- IT Project Management

- JavaScript development

- Laravel Development

- Magento Development

- MEAN Stack Developer

- MERN Stack Developer

- Mobile App

- Mobile App Development

- Nodejs Development

- Progressive Web Application

- python development

- QA and testing

- Quality Engineering

- React Native

- SaaS

- SEO

- Shopify Development

- Software Development

- Software Outsourcing

- Staff Augmentation

- UI/UX Development

- Web analytics tools

- Wordpress Development

Digital transformation in banking is more than just updating technology; it is redefining how banking is done and creating a user-centric experience. Embracing digitalization helps banks streamline their operations, increase security, and provide tailored customer services.

This article helps you to navigate the world of digitalization in banking and financial institutes, revamping the banking experience. So, let’s dive into it. Enjoy your reading!

What’s Digital Transformation in Banking

To put it simply, digital transformation in banking refers to the seamless integration of digital technologies and innovative strategies in banking or financial institutes. The prime aim of this is to enhance operational efficiency, adapt to the evolving market landscape, and, most importantly, boost customer experience.

Additionally, the top-tier banks in the US, such as JPMorgan, Bank of America Corp., and Citigroup Inc., use AI in their banking services, which is an example of digital transformation in banking and fintech.

This process incorporates the modernization or digitalization of traditional banking systems, processes, and business models, assisting banks in delivering smooth, convenient, and protected transactions via multiple digital channels.

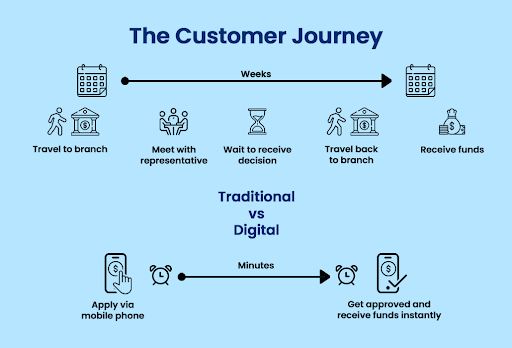

The Shift from Traditional to Digital Banking

Traditional banks have already harnessed advanced technologies for the digital banking revolution. This approach is a strategic movement towards better customer service, meeting customer expectations to adapt to evolving customer behavior in the digital environment. This process is reshaping how businesses engage with customers.

Key Aspects of Digital Transformation in Banking

Check out the main factors of digital transformation:

- Customization: Utilizing data analytics, artificial intelligence (AI), and machine learning (ML), banks can personalize the service and product based on every customer’s needs and interests.

- Robust Security Measures: Banks can easily exercise advanced cybersecurity solutions and protect customers’ sensitive data, prevent fraud, and ensure compliance with needed regulations.

- Automation and Process Optimization: Harassing technologies, such as robotic process automation (RPA) and AI, can enhance internal operations, minimize costs, and improve efficiency, streamlining overall workflow.

- Data-Enriced Decision-Taking: Leveraging big data analytics and robust algorithms, banks can make informed and data-driven decisions, optimize risk management, and drive innovation, ultimately contributing to overall growth.

- Omnichannel Banking: Another vital aspect of digital transformation in banking is bringing customers an integrated and seamless experience through multiple channels. This multichannel banking includes mobile apps, banking, ATMs, and physical branches.

- Smooth Collaboration with Fintech and Open Banking: Partnering with fintech startups or fintech service providers and incorporating open banking initiatives can foster innovation, enhance customer experience, and expand service offerings.

RELATED READ: Blockchain in Fintech: A Glimpse into 2024 and Beyond

Digital Technologies Powering Modern Banks Today

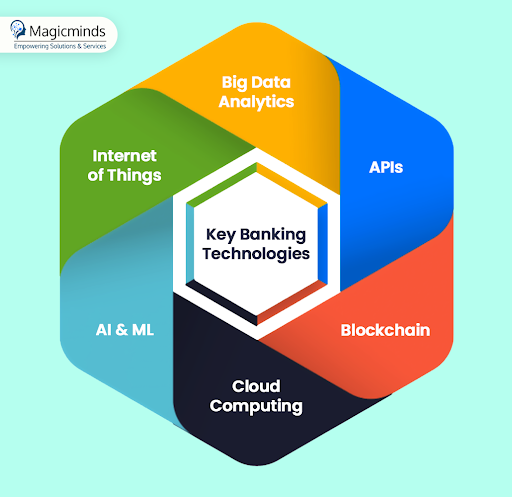

We’ve mentioned a few tools and technologies that the digital banking sector utilizes:

#1 AI & ML

Artificial Intelligence (AI) and Machine Learning (ML) are empowering the banking sectors these days. In banking, AI is mainly used by virtual assistants and chatbots to solve customers’ issues quickly and provide important information without human intervention, minimizing human labor.

Besides, AI is helpful in data security, data analysis, and data management, boosting user experience. For example, AI is great at recognizing repetitive patterns by analyzing consumer data.

Machine Learning (ML), on the other hand, stores and compares user data in real time. ML can detect fraud and help banks take timely preventive measures.

#2 Internet of Things

The Internet of Things (IoT) also transforms users’ banking experiences. It enables banks to analyze data efficiently, making the customer journey personal and customized. This is all thanks to IoT and its innovative connectivity among devices, which enables customers to make contactless payments within seconds hassle-free.

#3 Blockchain

Well, blockchain is an indispensable part of digital transformation in banking. Blockchain in the financial industry has resulted in more secure transactions, more enhanced interfaces, and more efficiency. Besides, the amalgamation of blockchain and IoT is considered to be the biggest technology trend in digital banking, making banking operations transparent and impenetrable.

#4 Cloud Computing

Cloud computing is the most considered technology banks and financial sectors have used. A cloud-driven service ensures faster operations, boosted productivity, and rapid delivery of services and products.

#5 Big Data Analytics

Big data analytics have helped banks analyze customer expenses, monitor risks, and manage feedback to improve customer satisfaction and loyalty. Besides, big data analytics can open new possibilities for software banking development and thus contribute to growing market demand.

#6 APIs

Application Programming Interfaces (APIs) are vital in the banking sector today. They enable businesses to connect with customers and partners and drive innovation. According to Forbes, in 2021, one in four institutions will invest in APIs to streamline their workflow.

Ready For Smarter Banking? Future-Proof Your Finances Now With Magicminds!

Challenges in Traditional Banking

#1 Outdated Technology

The technology that traditional banking depends on is outdated and requires updates to align with the evolving financial industry. This results in the slow development of the new features, restricted usage of several assets, and lack of integration with new services.

#2 Security and Privacy Issues

Maintaining the security and privacy of customers’ sensitive financial information and transactions is foremost. Traditional banking can be prey to cyber-attacks and data leakage, compromising the privacy of vital data.

#3 Inaccessibility and Inconvenience

Many customers look to access their accounts and financial information from remote locations, and traditional banking falls short due to its limited accessibility. Besides, availing of physical financial services is time-consuming and inconvenient.

#4 Inadequate Process and Less Customer Engagement

Traditional banking is tangled with insufficient processes, such as long queues, manual procedures, and a lack of transparency, leading to frustrated and unhappy customers. This negatively impacts customer satisfaction and increases operational costs in financial services.

#5 Lack of Scalability

Traditional banking requires scaling operations efficiently, increasing costs. This hampers their capabilities to expand into new markets or provide advanced services to customers.

READ MORE: Guide 101: Mobile App Security with Blockchain Development

How Does Digital Transformation Provide the Solution?

Digitalization in banking brings a new era to the financial sector, providing more than instant transactions and banking experience; it also creates opportunities for small to medium businesses to scale. Let’s have a look at how digital banking is a revolution itself!

#1 Customer Experience

The greatest way digitalization in banking has come up is by improving user experience comprehensively and enhancing omnichannel banking. It utilizes analytical technology solutions for a customer-centric approach and provides customers with tailored products and services. They consider customers’ preferences, interests, and purchasing attitudes.

#2 Strengthens Security

Digital transformation in banking now can overcome the years of struggle to protect customer data. However, banks now can secure sensitive information with sophisticated software development services and implement an impenetrable encryption and authentication process to save accounts and data from scammers, malware, hacking, phishing, etc.

#3 Compliance

An advanced digital financial management system has simplified banks’ compliance with regulations. Robust features, such as auto auditing, assist employees in minimizing the time they spend auditing reports and documents, saving them ample amounts of time. Additionally, the digital payroll system on the cloud helps update on time, which means the banks don’t need to worry about updating regulations.

#4 Embrace Efficient Process

By incorporating cutting-edge technologies, such as electronic signatures or the creation of banking apps for phones, banks aim to enhance their manual process efficiency. This helps them reduce human errors when dealing with customers.

#5 Cost-Cutting Formula

Another striking advantage of digitization in banking is it cuts costs for both banks and customers via nia payment and cashless transaction method usage.

Ready To Innovate? Build Your Custom FinTech App With Our Expert Developers!

Hire Top Developers!#6 Data-Driven Decision-Making

Digitalization helps banks in utilizing customers’ vast data effectively to make dynamic decisions. Technologies, including Big Data, help banks base their decisions or enhance processes on the available data of their customers.

#7 Get New Customers

Businesses need customers as much as customers need their services. With digitalization in banking, it has become easier to get new customers, enabling them to navigate their financial data and the required services at hand.

Embrace the Digital Future with Magicminds!

Digital transformation in banking is more than just a change; it is beyond transitioning from the traditional to the digital world. The entire digital transformation strategy lies in how banks and financial institutes can analyze, interact, and, thus, make the customer journey easier.

We hope this article helps you understand digital transformation in banking. If you require a technical partner in this area, look no further than Magicminds!

Being a reliable partner, Magicminds’ experts rigorously follow a methodical approach from planning and design to providing advanced data solutions to help you cater to your clients, fostering growth.

Don’t miss this opportunity. Get in touch with us today for digital transformation services for your banking business! Contact us!

Digital transformation in banking is more than just updating technology; it is redefining how banking is done and creating a user-centric experience. Embracing digitalization helps banks streamline their operations, increase security, and provide tailored customer services.

This article helps you to navigate the world of digitalization in banking and financial services, revamping the banking experience. So, let’s dive into it. Enjoy your reading!

| Table of Contents!

What’s Digital Transformation in Banking The Shift from Traditional to Digital Banking Key Aspects of Digital Transformation in Banking Digital Technologies Powering Modern Banks Today Challenges in Traditional Banking How Does Digital Transformation Provide the Solution? Embrace the Digital Future with Magicminds! |

What’s Digital Transformation in Banking

To put it simply, digital transformation in banking refers to the seamless integration of digital technologies and innovative strategies in banking or financial institutes. The prime aim of this is to enhance operational efficiency, adapt to the evolving market landscape, and, most importantly, boost customer experience.

Additionally, the top-tier banks in the US, such as JPMorgan, Bank of America Corp., and Citigroup Inc., use AI in their banking services, which is an example of digital transformation in banking and fintech.

This process incorporates the modernization or digitalization of traditional banking systems, processes, and business models, assisting banks in delivering smooth, convenient, and protected transactions via multiple digital channels.

The Shift from Traditional to Digital Banking

Traditional banks have already harnessed advanced technologies for the digital banking revolution. This approach is a strategic movement towards better customer service, meeting customer expectations to adapt to evolving customer behavior in the digital environment. This process is reshaping how businesses engage with customers.

Key Aspects of Digital Transformation in Banking

Check out the main factors of digital transformation:

- Customization: Utilizing data analytics, artificial intelligence (AI), and machine learning (ML), banks can personalize the service and product based on every customer’s needs and interests.

- Robust Security Measures: Banks can easily exercise advanced cybersecurity solutions and protect customers’ sensitive data, prevent fraud, and ensure compliance with needed regulations.

- Automation and Process Optimization: Harassing technologies, such as robotic process automation (RPA) and AI, can enhance internal operations, minimize costs, and improve efficiency, streamlining overall workflow.

- Data-Enriced Decision-Taking: Leveraging big data analytics and robust algorithms, banks can make informed and data-driven decisions, optimize risk management, and drive innovation, ultimately contributing to overall growth.

- Omnichannel Banking: Another vital aspect of digital transformation in banking is bringing customers an integrated and seamless experience through multiple channels. This multichannel banking includes mobile apps, banking, ATMs, and physical branches.

- Smooth Collaboration with Fintech and Open Banking: Partnering with fintech startups or fintech service providers and incorporating open banking initiatives can foster innovation, enhance customer experience, and expand service offerings.

RELATED READ: Blockchain in Fintech: A Glimpse into 2024 and Beyond

Digital Technologies Powering Modern Banks Today

We’ve mentioned a few tools and technologies that the digital banking sector utilizes:

#1 AI & ML

Artificial Intelligence (AI) and Machine Learning (ML) are empowering the banking sectors these days. In banking, AI is mainly used by virtual assistants and chatbots to solve customers’ issues quickly and provide important information without human intervention, minimizing human labor.

Besides, AI is helpful in data security, data analysis, and data management, boosting user experience. For example, AI is great at recognizing repetitive patterns by analyzing consumer data.

Machine Learning (ML), on the other hand, stores and compares user data in real time. ML can detect fraud and help banks take timely preventive measures.

#2 Internet of Things

The Internet of Things (IoT) also transforms users’ banking experiences. It enables banks to analyze data efficiently, making the customer journey personal and customized. This is all thanks to IoT and its innovative connectivity among devices, which enables customers to make contactless payments within seconds hassle-free.

#3 Blockchain

Well, blockchain is an indispensable part of digital transformation in banking. Blockchain in the financial industry has resulted in more secure transactions, more enhanced interfaces, and more efficiency. Besides, the amalgamation of blockchain and IoT is considered to be the biggest technology trend in digital banking, making banking operations transparent and impenetrable.

#4 Cloud Computing

Cloud computing is the most considered technology banks and financial sectors have used. A cloud-driven service ensures faster operations, boosted productivity, and rapid delivery of services and products.

#5 Big Data Analytics

Big data analytics have helped banks analyze customer expenses, monitor risks, and manage feedback to improve customer satisfaction and loyalty. Besides, big data analytics can open new possibilities for software banking development and thus contribute to growing market demand.

#6 APIs

Application Programming Interfaces (APIs) are vital in the banking sector today. They enable businesses to connect with customers and partners and drive innovation. According to Forbes, in 2021, one in four institutions will invest in APIs to streamline their workflow.

| Ready For Smarter Banking? Future-Proof Your Finances Now With Magicminds! Explore Our Solutions! |

Challenges in Traditional Banking

Traditional financial institutes have started taking visible initiatives to provide digital banking services to keep up with the constantly evolving market and customer demand and remain competitive. However, incorporating new-age technologies into the system isn’t as easy as anyone can think. The challenges they can face include:

#1 Outdated Technology

The technology that traditional banking depends on is outdated and requires updates to align with the evolving financial industry. This results in the slow development of the new features, restricted usage of several assets, and lack of integration with new services.

#2 Security and Privacy Issues

Maintaining the security and privacy of customers’ sensitive financial information and transactions is foremost. Traditional banking can be prey to cyber-attacks and data leakage, compromising the privacy of vital data.

#3 Inaccessibility and Inconvenience

Many customers look to access their accounts and financial information from remote locations, and traditional banking falls short due to its limited accessibility. Besides, availing of physical financial services is time-consuming and inconvenient.

#4 Inadequate Process and Less Customer Engagement

Traditional banking is tangled with insufficient processes, such as long queues, manual procedures, and a lack of transparency, leading to frustrated and unhappy customers. This negatively impacts customer satisfaction and increases operational costs in financial services.

#5 Lack of Scalability

Traditional banking requires scaling operations efficiently, increasing costs. This hampers their capabilities to expand into new markets or provide advanced services to customers.

READ MORE: Guide 101: Mobile App Security with Blockchain Development

How Does Digital Transformation Provide the Solution?

Digitalization in banking brings a new era to the financial sector, providing more than instant transactions and banking experience; it also creates opportunities for small to medium businesses to scale. Let’s have a look at how digital banking is a revolution itself!

#1 Customer Experience

The greatest way digitalization in banking has come up is by improving user experience comprehensively and enhancing omnichannel banking. It utilizes analytical technology solutions for a customer-centric approach and provides customers with tailored products and services. They consider customers’ preferences, interests, and purchasing attitudes.

#2 Strengthens Security

Digital transformation in banking now can overcome the years of struggle to protect customer data. However, banks now can secure sensitive information with sophisticated software development services and implement an impenetrable encryption and authentication process to save accounts and data from scammers, malware, hacking, phishing, etc.

#3 Compliance

An advanced digital financial management system has simplified banks’ compliance with regulations. Robust features, such as auto auditing, assist employees in minimizing the time they spend auditing reports and documents, saving them ample amounts of time. Additionally, the digital payroll system on the cloud helps update on time, which means the banks don’t need to worry about updating regulations.

#4 Embrace Efficient Process

By incorporating cutting-edge technologies, such as electronic signatures or the creation of banking apps for phones, banks aim to enhance their manual process efficiency. This helps them reduce human errors when dealing with customers.

#5 Cost-Cutting Formula

Another striking advantage of digitization in banking is it cuts costs for both banks and customers via nia payment and cashless transaction method usage.

| Ready To Innovate? Build Your Custom FinTech App With Our Expert Developers! Hire Top Developers! |

#6 Data-Driven Decision-Making

Digitalization helps banks in utilizing customers’ vast data effectively to make dynamic decisions. Technologies, including Big Data, help banks base their decisions or enhance processes on the available data of their customers.

#7 Get New Customers

Businesses need customers as much as customers need their services. With digitalization in banking, it has become easier to get new customers, enabling them to navigate their financial data and the required services at hand.

Embrace the Digital Future with Magicminds!

Digital transformation in banking is more than just a change; it is beyond transitioning from the traditional to the digital world. The entire digital transformation strategy lies in how banks and financial institutes can analyze, interact, and, thus, make the customer journey easier.

We hope this article helps you understand digital transformation in banking. If you require a technical partner in this area, look no further than Magicminds!

Being a reliable partner, Magicminds’ experts rigorously follow a methodical approach from planning and design to providing advanced data solutions to help you cater to your clients, fostering growth.

Don’t miss this opportunity. Get in touch with us today for digital transformation services for your banking business! Contact us!