Core Features Every Fintech App Needs in 2023

Tags

Stay In-the-loop

Stay In-the-loop

Get fresh tech & marketing insights delivered right to your inbox.

Share this Article

Category

- .Net Developer

- Adtech

- Android App Development

- API

- App Store

- Artificial Intelligence

- Blockchain Development

- Chatbot Development

- CMS Development

- Cybersecurity

- Data Security

- Dedicated Developers

- Digital Marketing

- Ecommerce Development

- Edtech

- Fintech

- Flutter app development

- Full Stack Development

- Healthcare Tech

- Hybrid App Development

- iOS App Development

- IT Project Management

- JavaScript development

- Laravel Development

- Magento Development

- MEAN Stack Developer

- MERN Stack Developer

- Mobile App

- Mobile App Development

- Nodejs Development

- Progressive Web Application

- python development

- QA and testing

- Quality Engineering

- React Native

- SaaS

- SEO

- Shopify Development

- Software Development

- Software Outsourcing

- Staff Augmentation

- UI/UX Development

- Web analytics tools

- Wordpress Development

The financial landscape is undergoing a remarkable makeover as digital transformation reshapes nearly every aspect of our lives. Fintech has taken center stage, and fintech apps have become our trusted partners in financial management.

Statista says the global FinTech market is projected to grow by 13.11% between 2023 and 2027, resulting in a market volume of US$5.27 trillion in 2027.

This explosive growth reflects the widespread adoption of fintech solutions across the United States and beyond. But what sets these apps apart? We will discuss it in detail here.

Must-Have Features for Today’s Fintech Apps

#1 Account Management and Transactions

- User Authentication and Onboarding

- Account Management

- Transaction History

- Fund Transfer

- Mobile Payments

- Bill Payment and Management

- International and Cross-border Transactions

#2 Financial Planning and Management

- Budgeting and Expense Tracking

- Savings and Financial Goals

- Investment and Wealth Management

- Credit Scoring and Monitoring

- Personalized Recommendations

- Insurance and Risk Management

#4 User Engagement and Support

- Customer Support and Chatbot Integration

- Instant Notifications

- Financial Education and Content

- Peer-to-peer (P2P) Lending or Crowdfunding

Must-Have Features for Today’s Fintech Apps

This blog will dive into the must-have features that define modern fintech apps. We’ll break down these features with real-life examples that showcase their value. Let’s explore how fintech apps revolutionize banking, investing, saving, and financial planning.

#1 Account Management and Transactions

User Authentication and Onboarding

User authentication and onboarding are the gateway to the world of financial management through apps. It’s crucial to strike a balance between security and convenience. Standard choices include Biometrics, one-time passwords (OTPs), and social media login options.

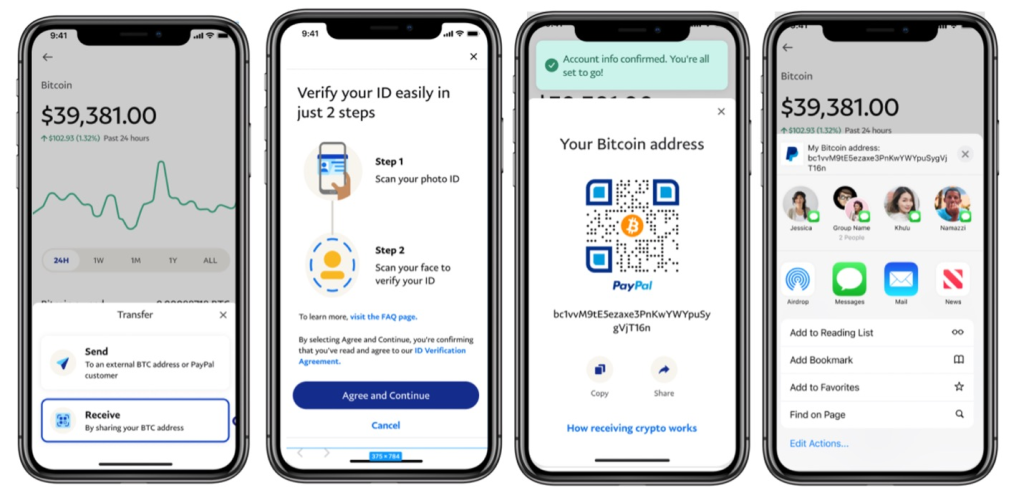

PayPal, one of the pioneers in digital payments, provides a seamless onboarding experience with email verification and mobile number confirmation. Users can also conveniently link their PayPal account to their Google or Facebook account.

Account Management

Modern fintech apps allow users to manage a wide array of accounts, from checking and savings to investment and cryptocurrency wallets, all in one place. Consolidating these accounts simplifies financial management.

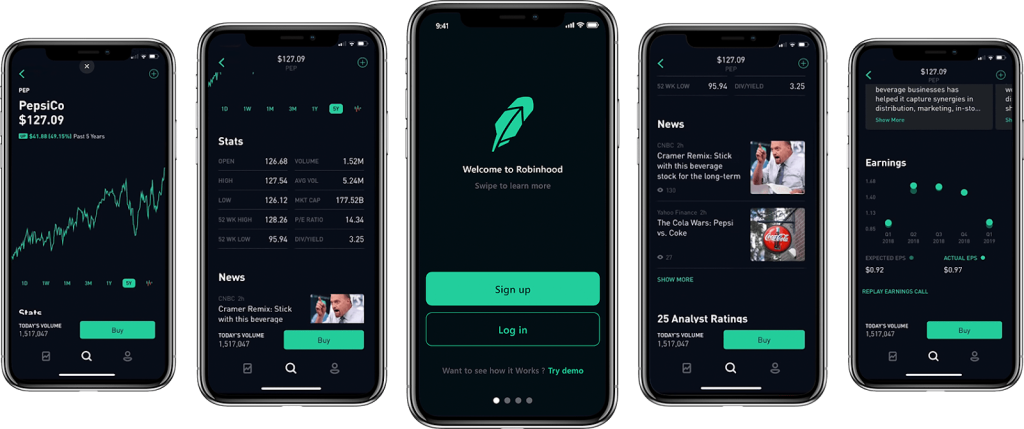

The Robinhood app allows users to manage traditional brokerage accounts and provides a platform for cryptocurrency trading. Users can easily switch between their investment portfolios and cryptocurrency wallets within the same app.

Transaction History

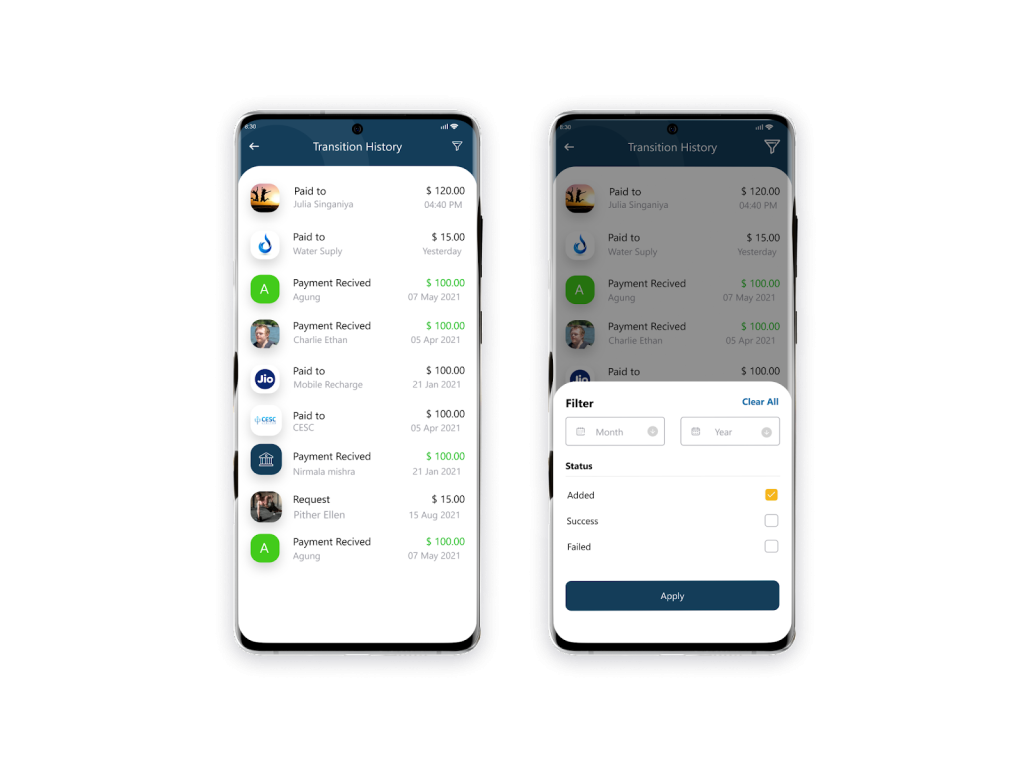

Transactions are typically categorized by date, type, and source/recipient, enabling users to track their spending patterns effectively.

Source: Magicminds

The Mint app by Intuit categorizes and organizes transactions automatically, offering users a clear view of where their money is going. Users can see their spending habits at a glance and set budgets accordingly.

Fund Transfer

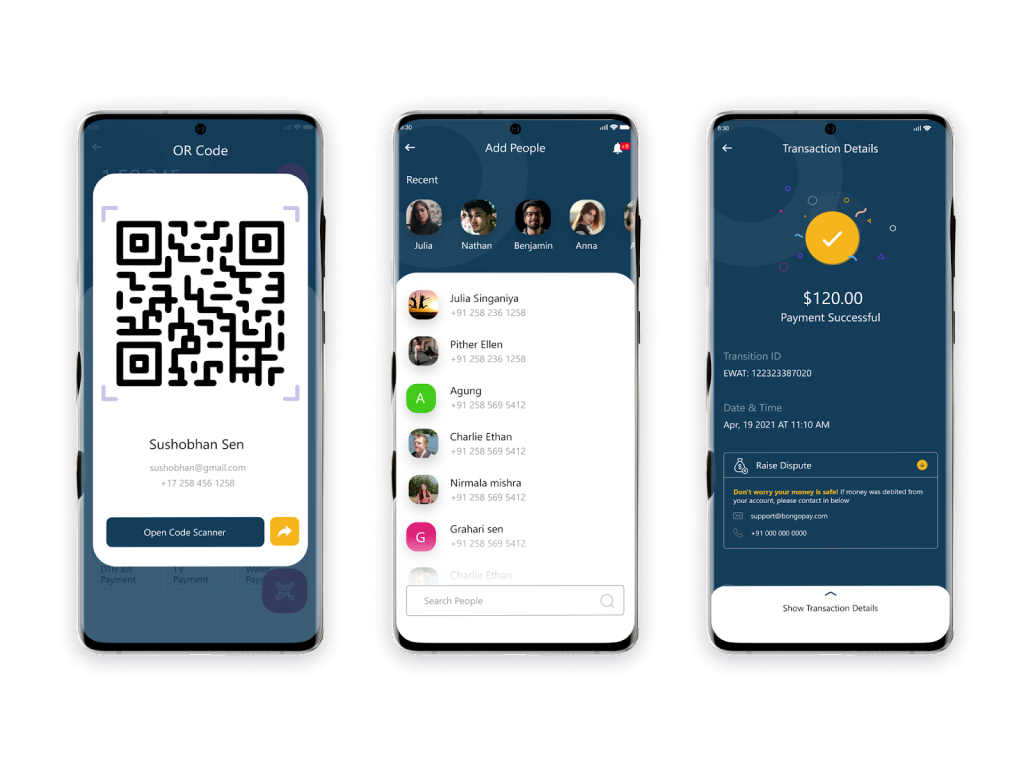

The seamless transfer of money is a cornerstone of fintech apps. Users should be able to move funds between their accounts, send money to other users, and make external bank transfers effortlessly.

Source: Magicminds

Venmo, a popular peer-to-peer payment app, allows users to transfer money to friends instantly. Users can also link their bank accounts or debit cards to fund these transfers.

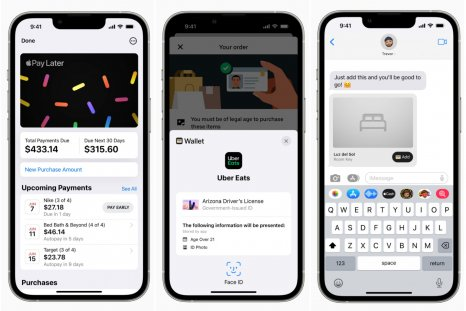

Mobile Payments

Fintech apps have revolutionized how we make in-store and online payments. Mobile wallets, QR codes, and NFC technology are now part of our daily financial transactions.

Apple Pay, integrated into Apple devices, lets users make secure payments in stores, apps, and websites using their iPhones, Apple Watches, or MacBooks. Users can add credit and debit cards to the app for convenient, contactless payments.

Bill Payment and Management

Managing bills and recurring payments have never been easier. Fintech apps allow users to pay bills, set up automated payments, and receive timely reminders to avoid late fees.

The Bill.com app streamlines business bill payments, invoicing, and expense tracking for small and medium-sized enterprises. Users can schedule payments, view invoice history, and get notifications when bills are due.

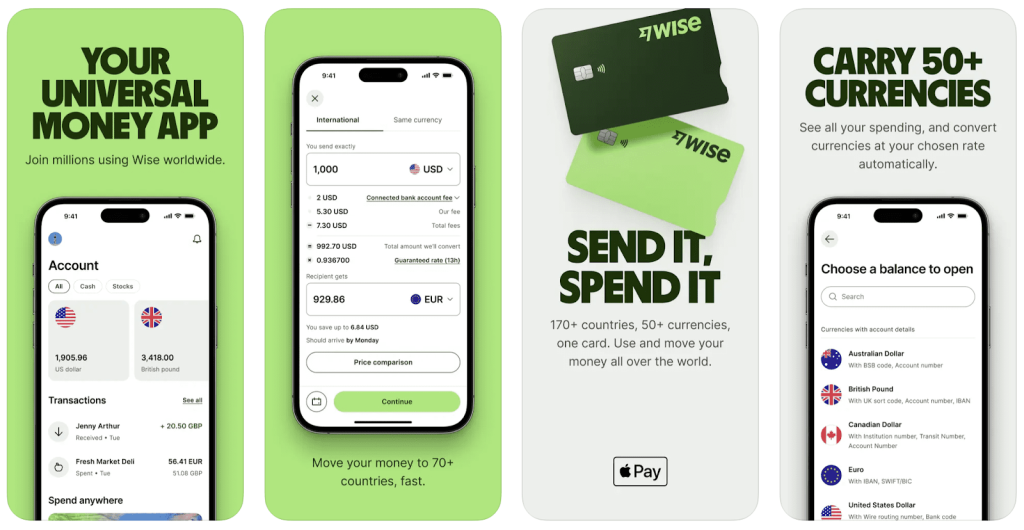

International and Cross-border Transactions

In our interconnected world, international financial transactions are commonplace. Fintech apps allow users to send money abroad, convert currencies, and manage foreign accounts efficiently.

TransferWise (now Wise) is known for its transparent and low-cost international money transfer services. Users can send money abroad with competitive exchange rates and minimal fees, all within the app.

#2 Financial Planning and Management

Budgeting and Expense Tracking

Effective financial planning starts with clearly understanding your income and expenses. Budgeting and expense tracking tools in fintech apps empower users to take control of their financial lives. These features categorize expenses, set spending limits, and offer insights into where your money is going.

![]()

YNAB (You Need a Budget) is a popular budgeting app that helps users allocate funds to different spending categories. It provides real-time updates on spending and encourages users to prioritize their financial goals.

Savings and Goals

Saving for short-term needs and long-term goals is made easier with fintech apps. Users can set savings goals, create automated savings plans, and track progress toward financial milestones.

Digit is an app that analyzes your spending habits and automatically transfers small amounts of money from your checking account to your savings account. It helps users save without even realizing it, making it easier to reach financial goals.

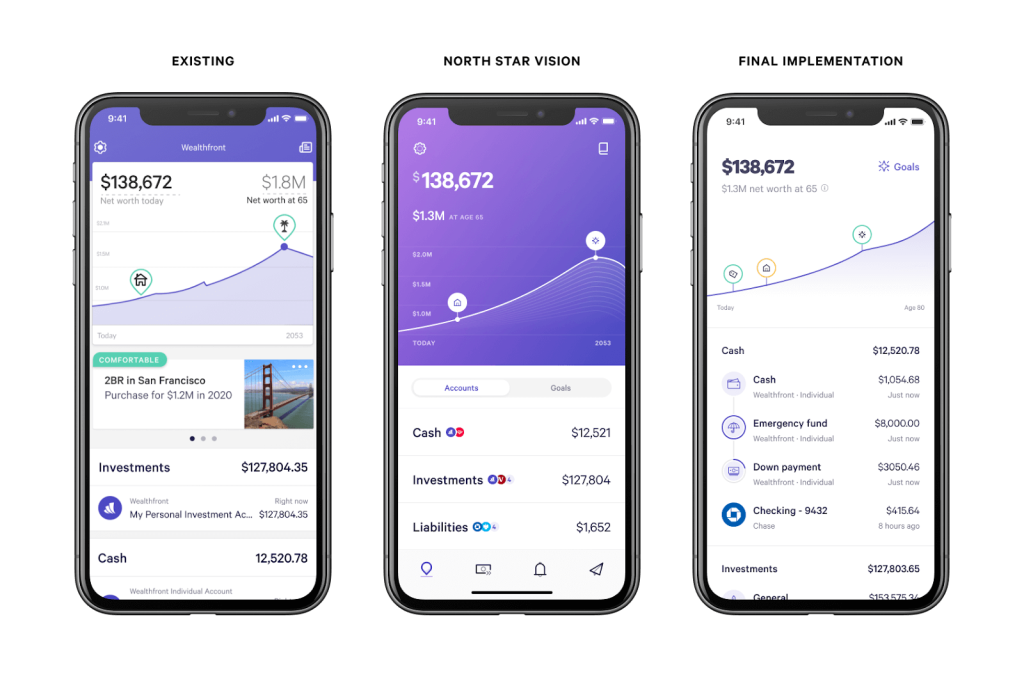

Investment and Wealth Management

Fintech apps have democratized investment and wealth management, offering a range of options from robo-advisors to self-directed trading. These platforms help users grow their wealth and achieve their financial aspirations.

Wealthfront, a robo-advisor platform, creates diversified portfolios for users based on their risk tolerance and financial goals. It automatically rebalances portfolios to optimize returns while managing risk.

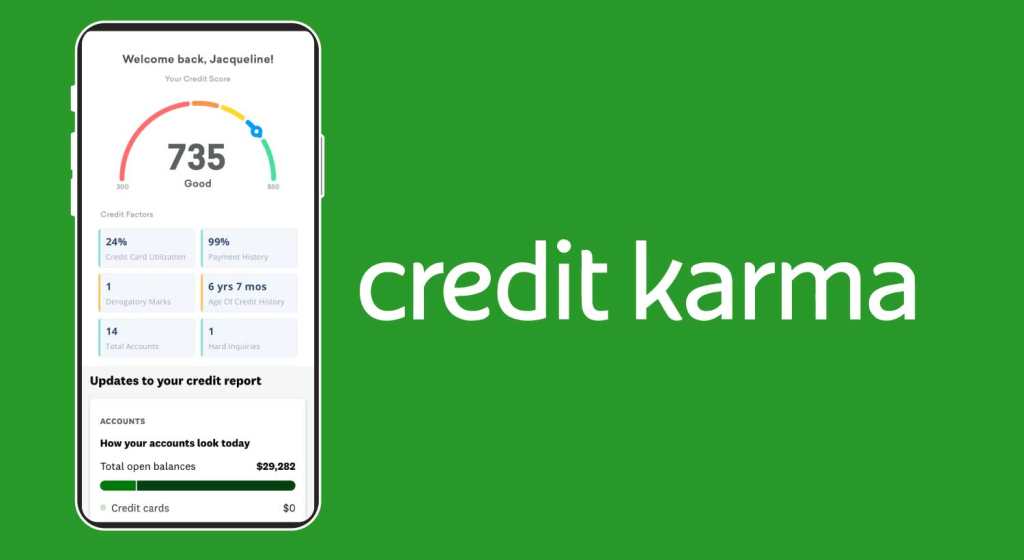

Credit Scoring and Monitoring

Your credit score is crucial to your financial well-being. Fintech apps provide tools to monitor your credit score, access credit reports, and receive tips on improving your creditworthiness.

Credit Karma offers free access to credit scores, credit reports, and personalized credit improvement recommendations. Users can track their credit health over time and receive alerts about changes to their credit reports.

Personalized Recommendations

Artificial intelligence (AI) algorithms are leveraged in fintech apps to offer personalized financial advice, product recommendations, and investment strategies tailored to individual user profiles.

Betterment, a robo-advisor platform, uses AI to create custom user investment portfolios. It considers risk tolerance, financial goals, and time horizon to provide personalized investment strategies.

Insurance and Risk Management

Fintech apps also address the need for insurance and risk management. Users can compare insurance policies, purchase coverage, and manage their policies in one convenient place.

Policygenius is an online insurance marketplace that allows users to compare and purchase various insurance products, including life, health, auto, and home insurance. It simplifies the process of finding the right coverage at the best price.

#3 Security and Compliance

FinTech apps must prioritize user data protection through advanced security features like encryption and multi-factor authentication. Regulatory compliance ensures that these apps operate within the bounds of financial laws and regulations, protecting users and the financial system’s integrity.

Additionally, open banking APIs foster innovation by enabling seamless integration with various financial institutions and expanding the range of services available to users. By prioritizing security and compliance, fintech apps build a foundation of trust that underpins their success in the market.

Plaid, a financial technology company, offers APIs that enable fintech apps to connect to users’ bank accounts securely. This allows apps to retrieve account information, verify balances, and facilitate financial transactions with user consent.

#4 User Engagement and Support

Customer Support and Chatbot Integration

A responsive and accessible support system is vital for fintech apps. Customer support, often powered by AI-driven chatbots, offers users quick answers to their queries and assistance with account-related issues, enhancing their overall experience.

Integrating voice assistants is taking user engagement to new heights. Users can perform financial transactions and access information through voice commands, making interactions with fintech apps more intuitive.

Instant Notifications

Timely communication is vital to keeping users informed and engaged. Fintech apps leverage instant notifications to update users about account activity, low balances, or suspicious transactions, ensuring they control their finances.

The Cash App sends users instant notifications for every transaction, ensuring transparency and security. Users receive real-time alerts for incoming payments, purchases, and withdrawals.

RELATED READ: Guide 101: Push Notifications in Mobile App Development

Financial Education and Content

Empowering users with financial knowledge is crucial to fintech engagement. Apps often provide educational resources, articles, videos, and interactive content to help users make informed financial decisions.

The CreditWise app by Capital One offers users access to educational articles and tools that help them understand credit, monitor their credit scores, and improve their financial literacy.

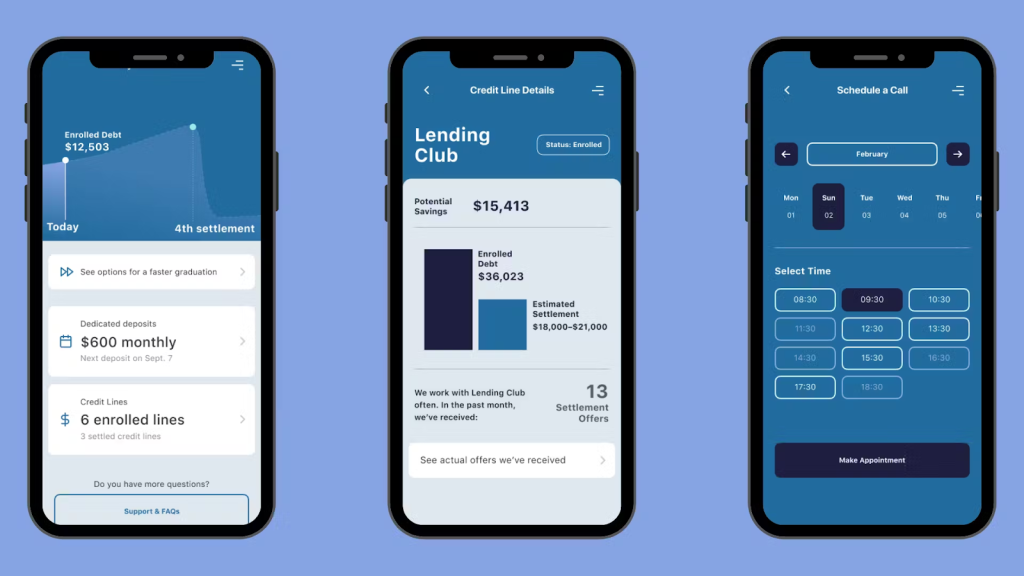

Peer-to-peer (P2P) Lending or Crowdfunding

Fintech apps are transforming lending and fundraising through P2P lending and crowdfunding platforms. Users can borrow from or lend to peers or participate in crowdfunding campaigns.

LendingClub is a P2P lending platform that connects borrowers with investors. Users can apply for personal loans or invest in loans, diversifying their investment portfolios.

#5 Data and Analytics

In fintech, data is power, and analytics tools provide users with invaluable insights into their financial health. Fintech apps offer features that generate comprehensive reports, income statements, balance sheets, and more, helping users understand their financial situation at a glance.

Source: Magicminds

Personal Capital combines users’ financial data from various accounts to provide detailed financial reports and personalized investment strategies. Users can easily track their net worth, monitor spending, and plan for retirement.

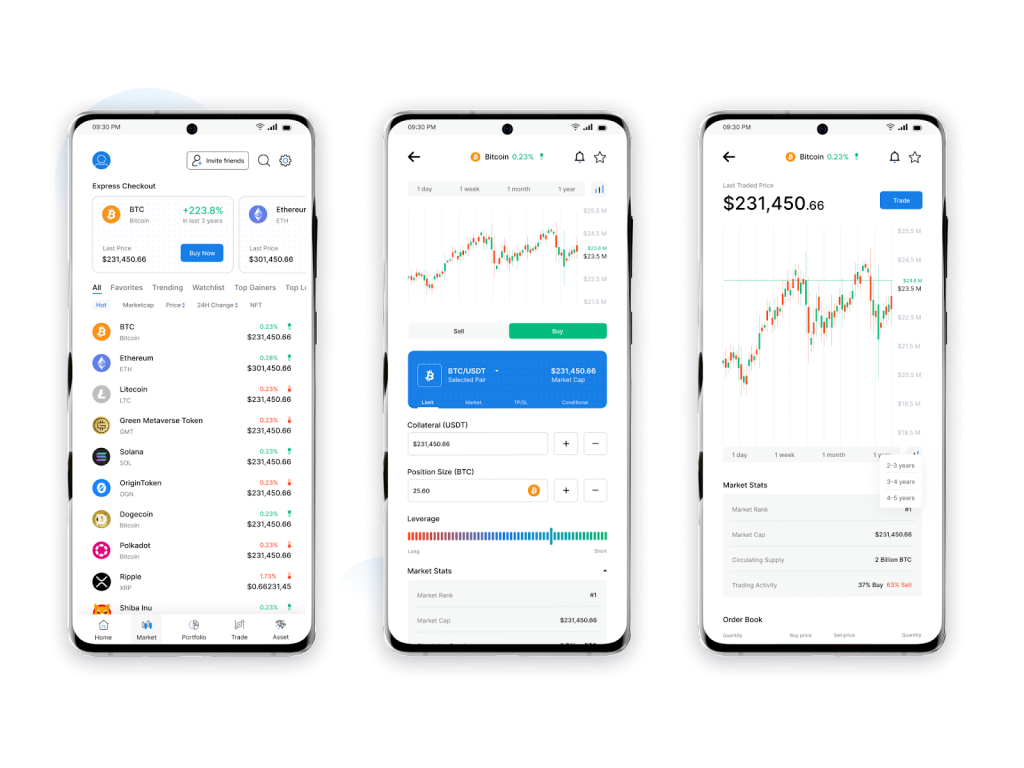

#6 Cryptocurrency Integration

The rise of cryptocurrencies has prompted fintech apps to integrate digital currencies into their platforms. These apps enable users to buy, sell, hold, and manage cryptocurrencies within the same interface as traditional financial assets.

Coinbase is a prominent example of a fintech app specializing in cryptocurrency integration. It provides people with a user-friendly platform to trade popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

Conclusion

Fintech apps are redefining how we manage money. These apps offer a holistic financial experience from user authentication to data analytics. Security and compliance are paramount, while open banking APIs expand horizons. As fintech evolves, it promises more personalized insights and cryptocurrency integration. The future holds even more significant potential, with AI-driven innovations, blockchain applications, and enhanced financial inclusivity on the horizon. Embrace the fintech revolution for a brighter, more accessible financial future with a proficient fintech app development company.