Payment Gateways Explained: Understand What You Need

Tags

Stay In-the-loop

Stay In-the-loop

Get fresh tech & marketing insights delivered right to your inbox.

Share this Article

Category

- .Net Developer

- Adtech

- Android App Development

- API

- App Store

- Artificial Intelligence

- Blockchain Development

- Chatbot Development

- CMS Development

- Cybersecurity

- Data Security

- Dedicated Developers

- Digital Marketing

- Ecommerce Development

- Edtech

- Fintech

- Flutter app development

- Full Stack Development

- Healthcare Tech

- Hybrid App Development

- iOS App Development

- IT Project Management

- JavaScript development

- Laravel Development

- Magento Development

- MEAN Stack Developer

- MERN Stack Developer

- Mobile App

- Mobile App Development

- Nodejs Development

- Progressive Web Application

- python development

- QA and testing

- Quality Engineering

- React Native

- SaaS

- SEO

- Shopify Development

- Software Development

- Software Outsourcing

- Staff Augmentation

- UI/UX Development

- Web analytics tools

- Wordpress Development

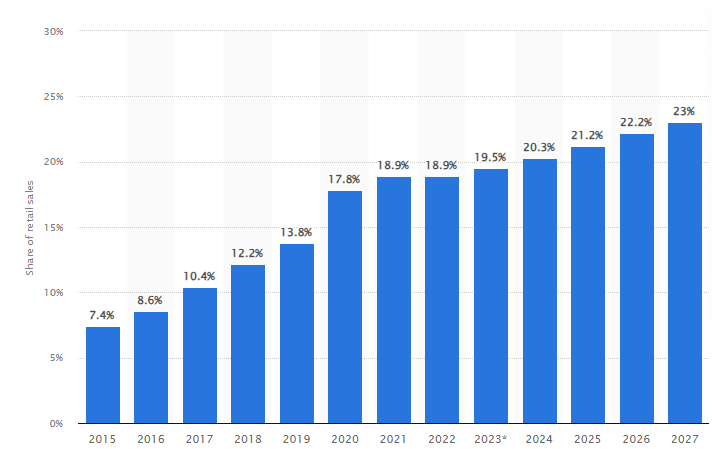

The emergence of technology has paved the way for new trends, and the eCommerce trend is one of the prevalent ones. Seamless eCommerce development amplifies the shift from offline to online shopping for customers worldwide. If you see the advent of eCommerce and its future, you will understand how online businesses are grabbing the market. This rise demands a private, smooth, and secure transaction, and that’s where the payment gateway plays a pivotal role. The importance of a secure payment gateway can directly affect your customer’s experiences and support you to collect payments from your target markets.

What is a Payment Gateway?

A payment gateway is equipment, tools, or technology that accepts credit or debit card payments from customers by concerned merchants. Let’s understand this in more detail.

Suppose you shop online through any eCommerce platform instead of inserting or swiping your credit or debit card through a machine. In that case, you enter your card details on the website or the app. The payment gateway is designed to validate the entered information, work on the transaction, and confirm the transaction from both you and the business’s end.

If you wonder why a payment gateway is required, you must understand that payment gateways enable eCommerce platforms to collect electronic payments or ePayments securely. This seamlessly transfers data from the eCommerce platform or mobile apps to the front-end processor- the acquiring bank.

Besides, payment gateway involves digital payments such as debit cards, credit cards, electronic checks, and online wallets. So, the prime concern of payment gateways is to collect and share sensitive information like card numbers, CVV numbers, etc., between customers to the online store owners and from that business to the transaction processor with high security.

What are the Benefits of a Payment Gateway

- The motto of the payment gateway is to ensure an easier, smoother, and hassle-free payment process with maximized security and safety.

- The right payment solution works beyond just faster transactions but significantly enhances the user experience with an intuitive and simple checkout feature.

- The payment gateway ensures that the payment process is secure. That’s why it practices robust encryption technology, protecting vital data and enabling users to benefit from a variety of payment methods, not to mention seamless internal transactions.

- Payment gateways play a key role in increasing the sales and revenue for the business. This solution allows you to access various audiences worldwide across different geolocations. Of course, this stimulates your business growth.

- With a simpler and automated transaction process, a payment gateway eliminates manual payment solutions, avoiding extensive paperwork and saving ample time and resources to aid you focus on more productive work.

- Besides, the payment gateway is designed to provide immediate feedback on whether the payment is approved or declined with a real-time payment process, assisting users with quick responses without keeping them waiting.

Considering Factors while Choosing the Right Payment Gateway

So, what is the most important factor in choosing a payment gateway? This is a very crucial question to raise. You must consider your online business’s requirements and look for a well-defined payment gateway. Let’s explore the factors of selecting the right payment gateway.

Seamless Payment Methods

The first thing is first. You must ensure having a fast yet smooth payment method. If your chosen payment gateway does not include the most preferred payment methods by customers worldwide, that is not useful for your business, right?

So, the payment gateway must offer credit, debit cards, digital wallets, or any other international payment methods or currencies. Besides, go for the payment gateway that adds an extra layer of transaction flexibility; failing may make you go through loss or, worse, lose the customer for good.

Customer’s Safety and Security

You may get questions about how do I choose an online payment gateway. Of course, security comes first when ensuring seamless and smooth online transactions. You must prioritize your customer’s safety and security of information; failing to do so may harm your brand identity and reputation while raising security concerns.

Check whether your opted payment gateway complies with the Payment Card Industry Data Security Standard (PCI DSS). Besides, ensure that the payment gateway supports advanced security steps, such as encryption, tokenization, etc, for protecting and securing sensitive customer information.

Effective Integration

Nothing can be achieved if the payment gateway does not integrate with your eCommerce business’s platform, shopping cart, account software, and other systems smoothly and quickly. Ensure to have an all-in-one inclusive payment gateway to unleash the power of faster transaction processing, merchant account, revenue management, and fraud scanning with preventive ways all under one roof care.

Transactional Fees

Yes, you have heard right that the payment gateway involves a fee charge for each transaction. This fee rate varies based on the transaction volume and provider. It is impartial to be well aware of the fee structure to understand its impact on the profit margins or revenues.

So, look for providers that support volume-oriented pricing, which eventually reduces the costs of payments while allowing high-volume transactions.

Customer Experience

The payment gateway for developing an eCommerce website must have a straightforward and user-intuitive interface. This gives customers an easy, smooth, and adaptable checkout process without redirections.

Too many complex checkout processes or redirection will lead them to leave your website for good. So, evaluate the payment gateway and consider having a smoother and faster checkout procedure with an enhanced customer experience for a more successful business.

Fraud Detection and Prevention

Look for a payment gateway that offers quick fraud detection and support to prevent that. With the built-in fraud scanning tools, payment gateways can detect fraudsters, helping you avoid potential losses with chargebacks.

These tools not only assist in fraud detection but are also beneficial in preventing fraud with more security and privacy so that you run your business smoothly without any cyber attack pressure.

Worldwide Transactions

Is international recognition your target? Then, you must include a strategy that ensures secure international transactions. Honestly, international transactions are never easy, like boiling water. So, if you have a plan to reach the international market, go for a payment gateway that supports different currencies and worldwide payment methods.

For instance, Stripe offers 135 currency acceptance, enhancing the internal digital payment experience while accepting global transactions smoothly.

Have a Merchant Account

Having a merchant account to store the funds for the time being is more important than you think. A merchant account refers to a retailer account where a customer’s digitally paid money is stored and processed to your bank account once it gets approved by your customer’s bank. Although it appears to be a critical task, it is essential, not to mention the additional layer of security it brings.

Enable Mobile Payment

In the future, mobile payment will be a prevalent path as it assists in having a handy transaction process. So, your chosen payment gateway must enable an effortless mobile payment option, allowing users to pay through their mobile devices.

Digital mobile wallets such as Apple Pay, Google Pay, Samsung Pay, and more have changed the dimension of online payment, and users are adopting these methods disruptively.

Supportive Hands

The importance of a payment gateway lies in its supportive nature. To be more precise, customer support is your ticket to having a smooth and profitable online business with increased revenue. So, you must have access to a payment gateway that has 24*7 around-the-clock customer support, ensuring clients with real-time responsive service effectively.

Examples of Popular Payment Gateways

So, what is the best payment gateway for online business? It is difficult to decide. However, we ask you to redefine your requirements first and then research the features, reviews, and functionalities of available payment gateways and then choose your payment gateway.

Below are a few payment gateways with their features.

Stripe

Stripe has been one of the preferred and topmost payment gateways since 2010. Stripe is committed to eCommerce businesses through its comprehensive developing tools, better API, and personalized website features per your requirements.

So, what sets this apart?

- Appropriate for international transactions.

- Enhanced website and user experience

- Tailored website with smooth and easy features

Amazon Payments

Amazon Payment is an exclusive eCommerce payment gateway that works efficiently. This auto-fills the data while checking-ins and checking-outs if the customer has an Amazon account.

Let’s check its standout features.

- Offers a simple, smooth, and secure payment option.

- Amazon does have any hidden charges, and it does not charge you anything for its A-to-Z Guarantee.

- You can smoothly personalize the Amazon Payments site.

Skrill

UK-oriented eCommerce payment gateway Skrill can be the best choice for businesses and customers. This offers extensive international payment options to customers, and active users can have a prepaid Mastercard and buy the products later on.

So, what are their key features?

- Offers in-app transactions

- Well-integrating with third-party shopping basket

- Hosts payment page.

Orange Pay

Orange Pay is considered one of the prime payment gateways, assisting complex problems, eliminating risks, and ensuring protection from fake payments. Orange Pay can minimize the risks through SSL encryption and 3D security. With this, users get extensive payment channels, such as VISA, MasterCard, PayPal, Qiwi, Krill, Bitcoin, and more with efficiency.

Let’s have a look at its prime features.

- Supports remote account opening

- Offers anti-DDoS

- Seamless chargeback control.

PayU

As an Indian payment facility, PayU is preferred for its quick and easy payment solution for eCommerce. Leveraging PayU, you can get a striking conversion rate over any other payment method. You can integrate this incredible solution with other websites, applications, etc, through the PayuBiz APIs and SDKs.

So, why should you consider having PayU?

- With a tokenized system, you can store your customer’s card details safely.

- Supports the going live feature and starts taking payment within 5 minutes.

- Allows payment on a single tap, avoiding entering CVV digits repeatedly.

- This solution can read and submit the OTP without the customer’s involvement while ensuring the highest PCI and DSS standards for payment security.

PayPal

Established in 1999, this platform avoids setting up expenses and monthly charges or gateway transaction fees. For MasterCard and credit card-holding buyers, it’s completely free; however, it charges transaction fees from merchants while using VISA.

So, what’s its USPs?

- Suitable for low-volume merchants

- All-inclusive platform

- Supports payment through a PayPal account even though customers leave the website for checking out

CheckOut2

Nothing can match the instant payment solution like 2CheckOut. This US-based payment gateway is designed to support 87 currencies with 15 different languages in the global market.

So, what makes it different from other payment solutions?

- Its resource documentation is highly accessible, which supports customization of the checkout process, catering to a tailored user experience.

- Suitable for international payment solutions.

- Compelling website and advertising.

Conclusion

In the end, we can say that a faster, smart, and effective payment gateway is essential for a smooth payment process in your eCommerce platform. This offers efficient and secure transactions for the customers. However, you must consider the factors while choosing the right payment gateway for your business, fostering growth and increased revenue. For that, consider having an eCommerce development service like us Magicminds. So, what are you waiting for? Grab the opportunity and uplift your payment process today!