Project Overview

BongoPay serves in France, Italy, Congo, and Canada. Gilbert Colombo has allowed us to work on this web application specially designed to transfer money by scanning the QR code. Users can quickly scan the QR code with their wallet to accomplish the transaction.

With Bongo Pay's ingenious platform, users quickly transfer money by scanning a QR code with their digital wallet, delivering a seamless, safe, secure, and trendy way to conduct transactions.

Gilbert

CEO, BongoPay

Loud & Proud Numbers that Speak Accomplishment

in online wallet transactions

in total number of customers

in payment loading times

in collaboration via chat

in users for payment status with one click

in average user engagement session

Project Back Story & Challenges

With the client's vision to build a robust wallet-to-wallet transaction application in mind, we, at Magicminds embarked on the journey of devising it. The client emphasized ensuring success and reliability. Our initial analysis revealed a series of pivotal hurdles that demanded innovative solutions.

- Protecting financial data from cyber-attacks, which requires deploying cutting-edge encryption protocols, constantly observing unique activity, and revising safety benchmarks to safeguard against new hazards.

- Proactively managing the platform's response to demand changes, ensuring strength and resilience.

- Robust data encryption, stringent access controls, and, most importantly, adherence to privacy regulations like GDPR, assuring user confidentiality.

- Integrating digital wallets, necessitating the use of secure APIs, rigorous authentication methods, and data integrity.

Solutions Offered By Magicminds

Faced with these challenges, we devised and deployed a set of cutting-edge solutions customized to meet BongoPay's unique demands. Utilizing advanced technologies and forward-thinking strategies, we transformed BongoPay into a secure, reliable, and user-friendly wallet-to-wallet transaction platform.

- We executed a robust encryption protocol using Plaid's secure connectivity features to safeguard against cyber-attacks, ensuring the safety and integrity of user data during transactions.

- By integrating Stripe, BongoPay users can transfer money confidently and effortlessly, improving their prevalent experience and trust in the platform.

- By integrating Plaid's secure APIs, we improved transaction protection, delivering an extra layer of security for user accounts and susceptible data.

- We prioritize standard testing, safety checks, and unique features, utilizing Plaid and Stripe capabilities to enhance the platform's security and functionality, ensuring continuous progress and user satisfaction.

Highlighted Features of BongoPay

-

Ticketing System

The payment might get stuck in between while transferring or receiving the money, so there is an option to file a ticket through which the Admin can view the ticket and do what is needed.

-

Language Flexibility

Since BongoPay operates across multiple countries, it is available in English, French, Portuguese, and Spanish.

-

Easy Money Transfer

Users can quickly transfer money from wallet to wallet within 3–4 seconds. Also, money can be sent through QR code by scanning the same.

-

Wallet-to-Bank Transaction

BongoPay users can transfer funds hassle-free and securely from their digital wallet to their linked bank accounts with ease.

-

Proactive Notifications

Users get real-time updates on transactions, account activity, and important security alerts from BongoPay to stay aware and secure.

-

One-Tap Business Payments

BongoPay allows users to make fast, secure, and convenient payments to vendors and partners with a single tap.

-

Ironclad Security with MFA

With advanced encryption, security protocols, and MFA BongoPay ensures user data protection and safeguards against potential cyber-attacks.

-

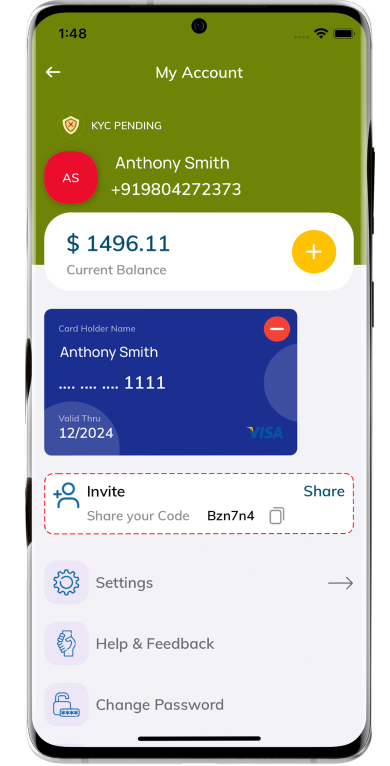

Know Your Customer

BongoPay detects a human by scanning their face for a KYC update. Accessing the app without verifying or updating the Onfido KYC is impossible.

-

Add Money Effortlessly

BongoPay users can easily add money to the wallet through a debit card, credit card, or net banking.

The Result

Our ambitions at BongoPay were to mitigate direct user challenges, improve the system performance, optimize the user interface, and raise transaction dependability. Here are the quantifiable outcomes of our collective exertions with this payment platform.

- 41% increase in transaction efficiency

- 40% increase in average user engagement session

- 23% decrease in processing costs

- 35% surge in total number of customers

Exclusive Insights to How We Transformed BongoPay

Get Limited Access to This Case Study and Learn from its Success!

FinTech

BongoPay

Services Provided: Design, Development, Deployment

Highly recommend Magicminds!

I really love working with these guys! After they successfully built BongoPay, our eWallet platform, I was so satisfied with the outcome that I decided to partner with them for my next project, which is a recruitment portal. Highly recommend Magicminds to anyone looking to bring their digital payment dreams to life!